Manufacturing

Amid persistent supply chain uncertainty and rising production costs, Nordic manufacturers are increasingly looking east — not far, but across the Baltic Sea. Nearshoring production to Estonia, Latvia, and Lithuania has become a strategic move, offering a mix of cost efficiency, skilled labor, and logistical speed.

In 2024, average gross monthly wages in the Baltic states were:

– Lithuania: €1,900 (↑10.4%)

– Latvia: €1,630 (↑11.4%)

– Estonia: €1,960 (↑8.8%)

By comparison, average wages in Nordic countries were nearly double:

– Sweden: €3,800

– Finland: €3,700

– Denmark: €5,200

– Norway: €5,600

Despite recent wage growth in the Baltics, the gap remains significant — and so does the opportunity.

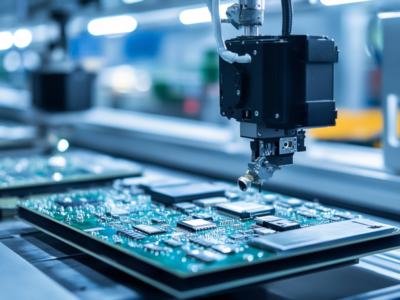

For Nordic exporters in labor-intensive sectors like furniture, electronics assembly, and metal components, shifting production or supply partnerships to the Baltics can cut labor costs by 40–60%, depending on the sector. Just as importantly, production stays within the EU customs zone, easing compliance and documentation.

Lead times are another advantage. Products moved by road between Vilnius and Stockholm or Riga and Helsinki typically arrive within 24–48 hours — far faster than shipments from Asia. Baltic logistics hubs like the Port of Klaipėda and the Freeport of Riga have been investing in faster clearance and multimodal links, adding to the appeal.

Case in point: the number of Swedish and Finnish companies operating in Lithuania’s industrial zones has grown by over 25% since 2020, with Sweden now ranking among the top five foreign investors in Lithuanian manufacturing. In Latvia, exports of intermediate goods to Finland rose by 18% in 2024 alone, driven largely by increased sub-system assembly and cross-border supply contracts. This reflects a broader trend: Nordic firms are building out leaner, closer, and more reliable production chains across the Baltics.

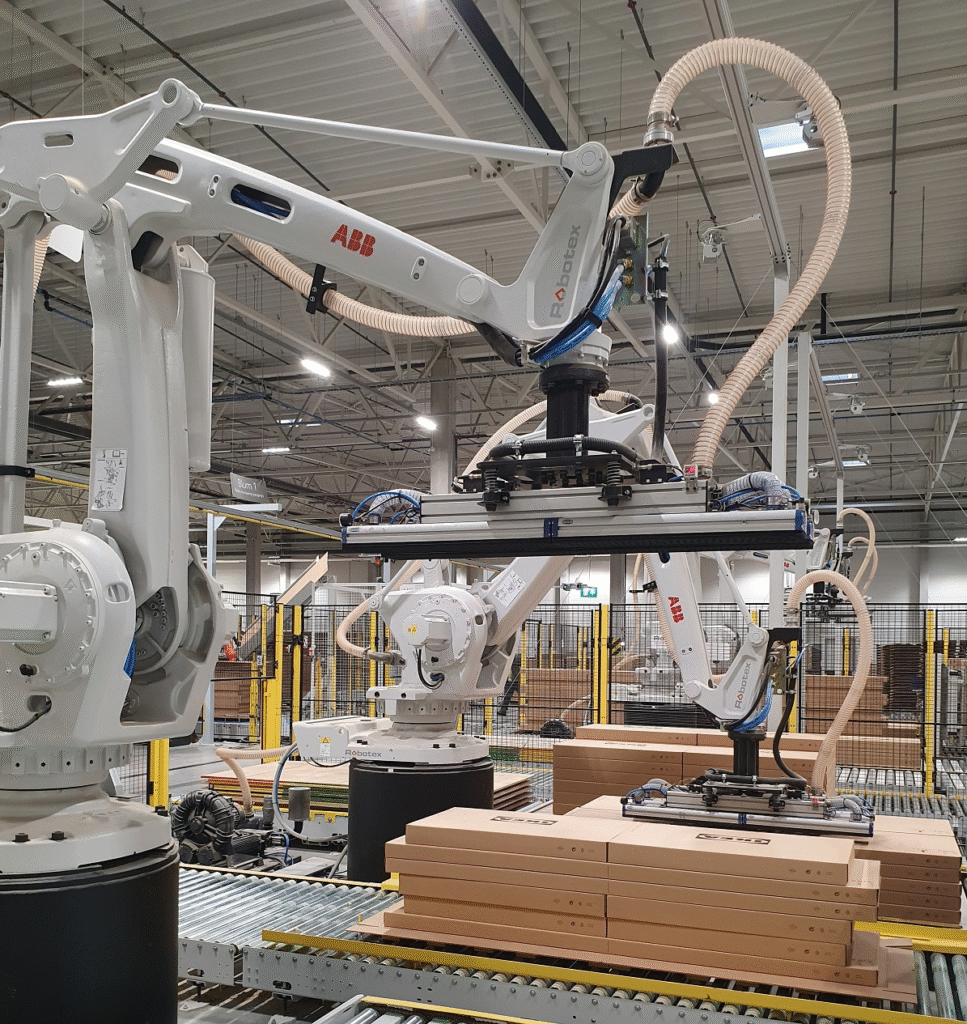

For Baltic manufacturers, the wave of Nordic nearshoring is a growth opportunity. It encourages upskilling, investment in automation, and deeper integration into European value chains.

As 2025 unfolds, this cross-Baltic production model is gaining traction — not just for cost reasons, but as a strategic shift toward resilient, regionalized supply networks.